5 accounting software failures that lead to business risks

Accounting is a crucial process for businesses of all sizes, and it requires a high level of precision and accuracy. Therefore, many organizations are now using accounting software to minimize the risk of human errors. However, mistakes are often encountered despite using automated software. Even a minor error can lead to significant problems for the business. Therefore, it’s important to be aware of the potential failures of accounting software, which can ultimately lead to business risks.

What is the function of an accounting software?

Before getting into different issues encountered with accounting software, it is crucial to understand the ways in which it can benefit an organization. Generally, an organization uses accounting software for the following purposes:

- Automation of financial process

- Quick access to critical information

- Efficient workflow when a large amount of data is involved

- Accurate calculations and precise processing of operations

Challenges involved in the development of accounting software

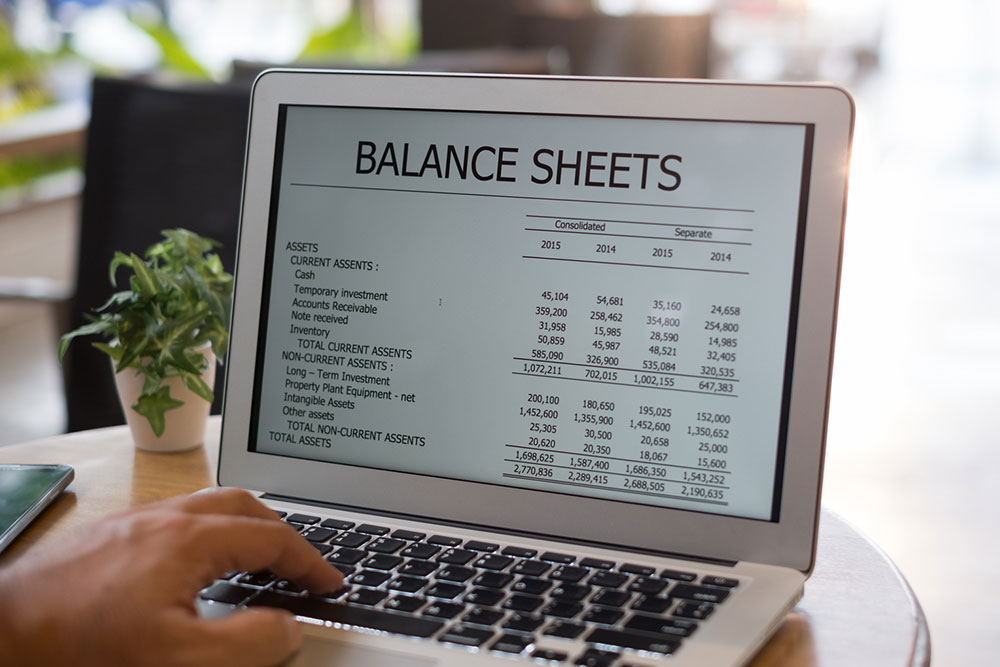

Accounting software can be a useful tool for businesses and professionals to keep track of sales, profits, cash flow, cash reserves, loan allocations, and billing information. This is often sufficient for small businesses. However, larger businesses may require more advanced accounting software that has the capability of generating balance sheets, bank balances, and the value of creditors, debtors, and assets.