7 common tax refund errors to avoid

A taxpayer usually files for tax refunds for various reasons, including acquiring a big refund each year or to lower the tax bill and help save on a paycheck. In either case, every aspect of the documentation and process needs to be right for the refund to work. A single mistake could mean a stalled refund, or the taxpayer might receive a letter from the IRS about the filing error.

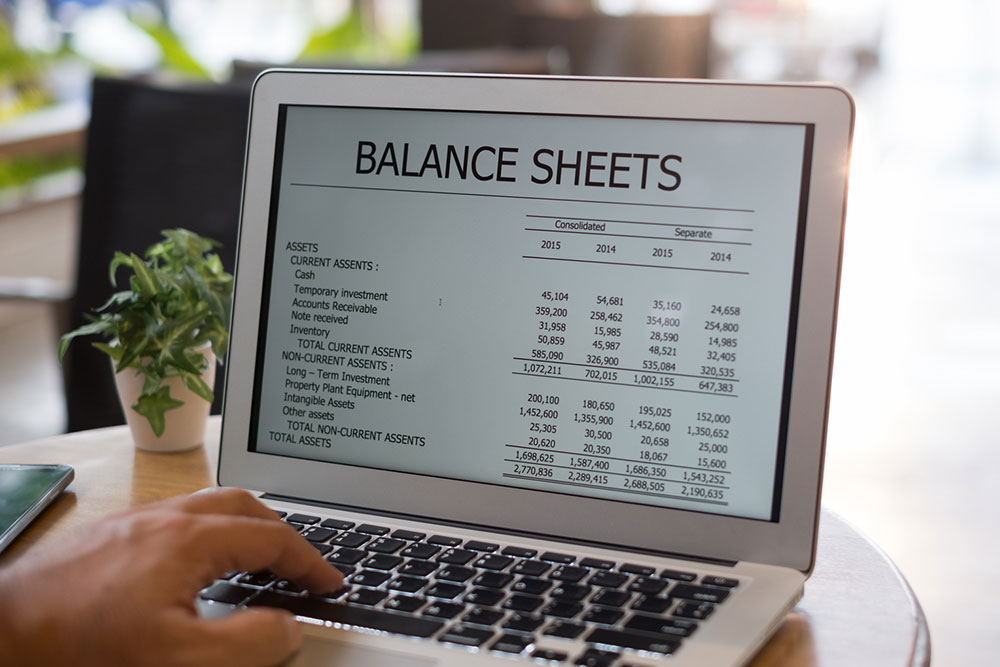

Mathematical errors

One of the most common tax return mistakes is mathematical errors. A single error in decimal points, an extra zero, or a missing zero in the document could hamper one’s return. Even minute addition or subtraction errors could delay one’s refund or result in one getting a smaller refund than they were expecting. To avoid these issues, one should have an expert handle the calculation process. Additionally, online calculators could check their math and get accurate results within seconds. Still, despite the benefits of online tools, it is best to get it cross-checked by an accountant just to be safe.

Claiming incorrect credits or debits

It is important to understand the difference between tax deductions and tax credits when managing tax returns. A deduction reduces the amount of income one pays tax on.